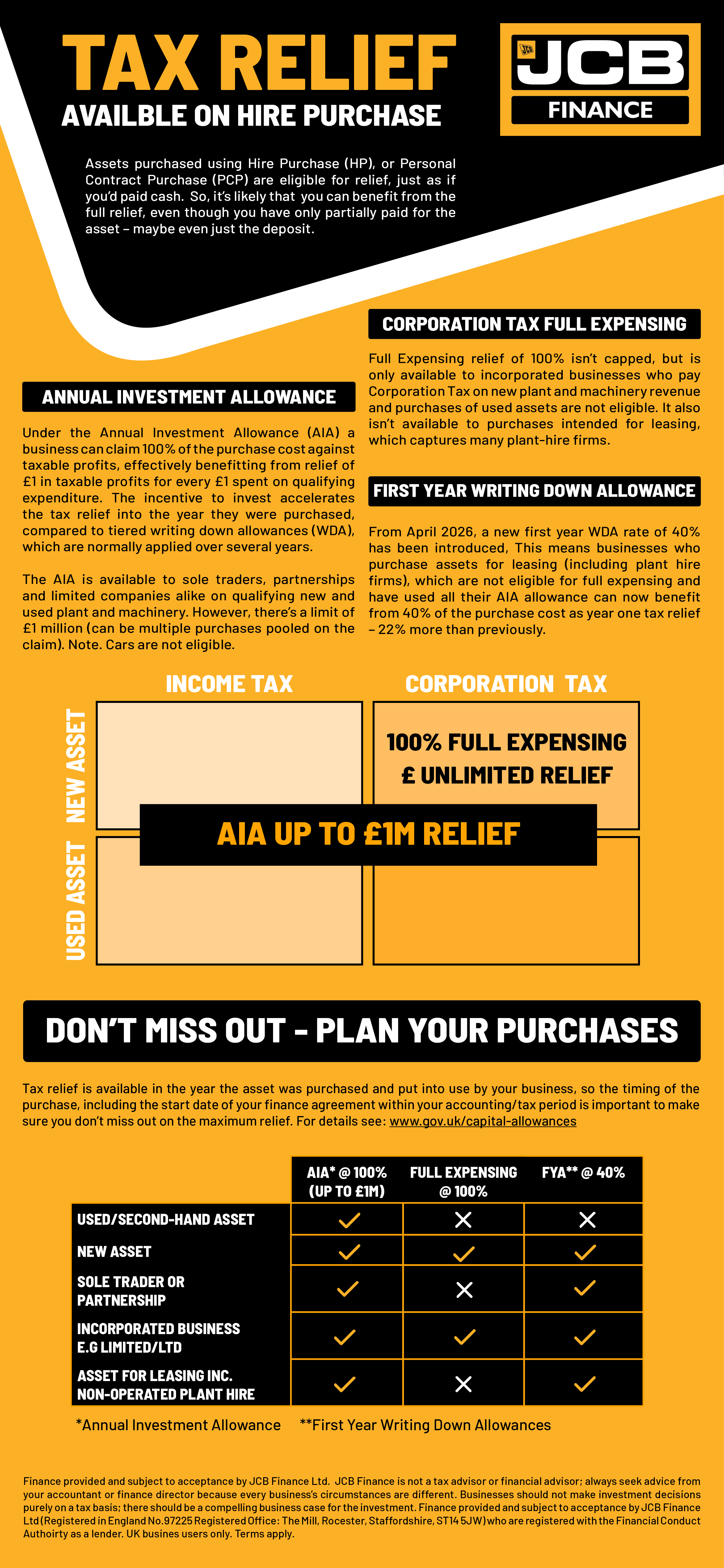

Assets purchased using Hire Purchase (HP), or Personal Contract Purchase (PCP) are eligible for relief, just as if you’d paid cash. So, it’s likely that you can benefit from the full relief, even though you have only partially paid for the asset – maybe even just the deposit. Cars are not eligible.

The capital allowances regime you apply may vary depending on if you are;

- • a sole trader / partnership or an incorporated business e.g. Limited company,

- • if the asset is for your own business use or intended for leasing, including plant hire without an operator

- • if the asset is new or used

- • and how much you have already claimed, as some limits may apply.

JCB Finance can tailor payment profiles to meet the needs of your business, such as tax payments/rebates and seasonal cashflow of your business so accessing tax relief in a way that is easy on your cashflow has never been easier. Click here to get in touch with your local Relationship Manager.

JCB Finance is not a tax advisor or financial advisor; always seek advice from your accountant or finance director because every business’s circumstances are different. Businesses should not make investment decisions purely on a tax basis; there should be a compelling business case for the investment. UK business users only; terms apply.

JCB Finance Ltd Registered in England No.972265 Registered Office: The Mill, Rocester, Staffordshire, ST14 5JW. JCB Finance Ltd is authorised and regulated by the Financial Conduct Authority (Firm Reference Number: 708332). Finance is restricted to business users in the United Kingdom, subject to acceptance by JCB Finance Ltd and affordability checks.